Est Tax Payment Dates 2025

BlogEst Tax Payment Dates 2025. Monday, april 15, 2025, is tax day, the deadline for filing a federal income tax return. If a payment is mailed, the date of the u.s.

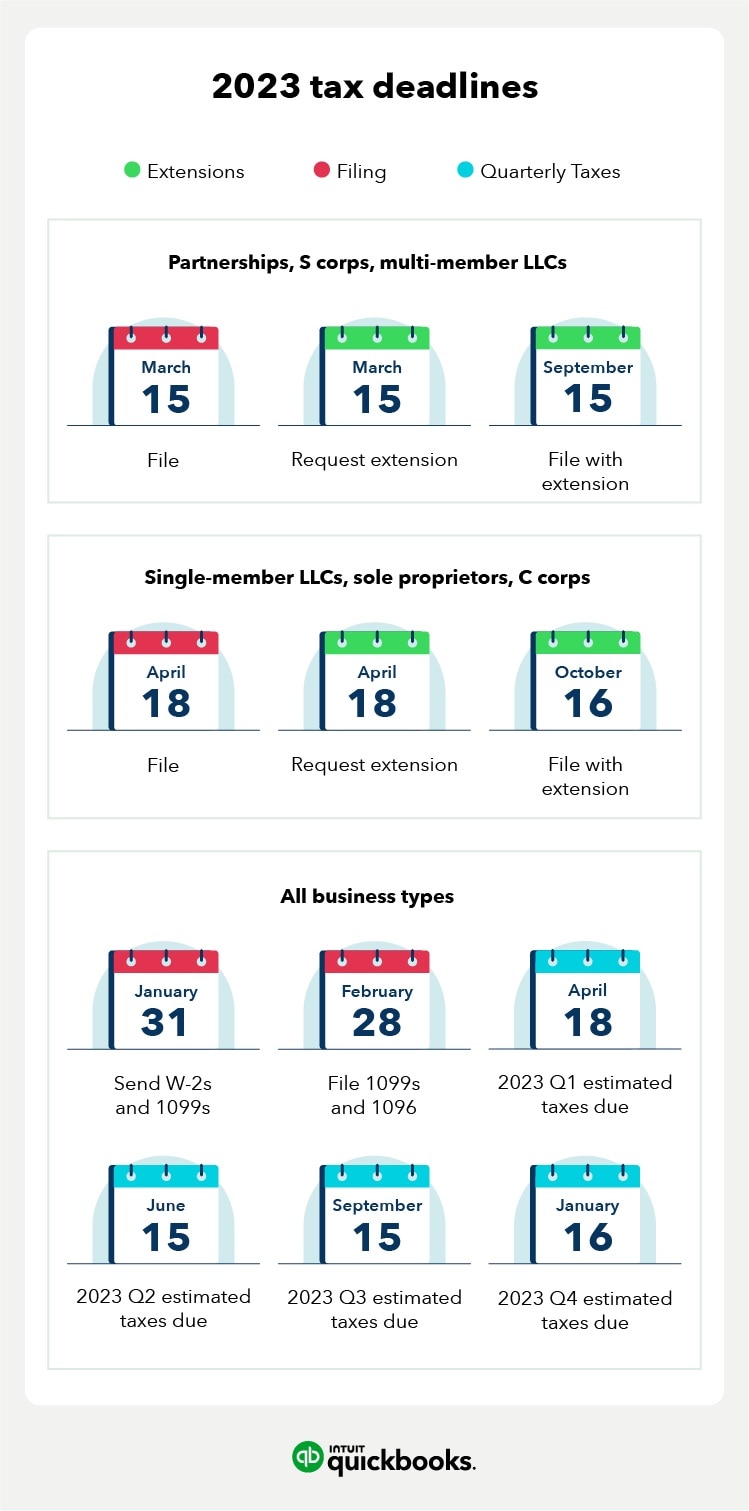

The following dates are the tax dues dates in 2025. Get the latest money, tax and stimulus news directly in your inbox.

Washington — the internal revenue service today reminded taxpayers who didn't pay enough tax in 2025 to make a fourth quarter tax.

2025 Tax Season Calendar For 2025 Filings and IRS Refund Schedule, Most of the due dates discussed in this publication are also included in the online irs tax. Includes related provincial and territorial programs.

Federal Tax Calendar 2025 Barbe Carlita, What they are and who needs to make them in 2025. April 15, june 15, sept.

Reducing Estimated Tax Penalties With IRA Distributions, You can pay all of your estimated tax by april 15, 2025, or in four equal amounts by the dates shown below. Before you start thinking about your 2025 estimated taxes, you need to make the last of your 2025 estimated tax payments.

Estimated IRS Tax Refund Dates Warner Pearson Vandejen & Consultants, Washington — with millions of tax refunds going out each week, the internal revenue service reminded taxpayers today that recent. Postmark is the date of payment.

![Estimated Tax Due Dates [2025 Tax Year]](https://youngandtheinvested.com/wp-content/uploads/estimated-tax-due-dates.png)

Estimated Tax Due Dates [2025 Tax Year], What are financial year (fy) and. Generally, you must make your first estimated tax payment by april 15, 2025.

2025 Tax Deadlines for the SelfEmployed, Interest under section 234c is levied at 1% rate per month for three months and interest will be levied if a taxpayer has failed to pay advance tax or paid less than 90% of the assessed. The due date for the deposit of tax deducted/collected for february 2025.

Tax Refund Cycle Chart 2025 2025, Monday, april 15, 2025, is tax day, the deadline for filing a federal income tax return. Generally, you must make your first estimated tax payment by april 15, 2025.

2025 March Calendar With Tithing Meaning Chart October 2025 Calendar, 15 of the following year, unless a due date falls on a. Neet ug 2025 will be conducted on may 5 from 2 pm to 5.20 pm in 14 cities in offline mode.

Form 1040 ES, Estimated Tax for Individuals Internal Revenue Service, First estimated tax payment due. (status = return received) irs processing.

IRS 2025 Estimated Tax Payments Scribe, Washington — with millions of tax refunds going out each week, the internal revenue service reminded taxpayers today that recent. 2025 estimated tax payment deadlines.

Interest under section 234c is levied at 1% rate per month for three months and interest will be levied if a taxpayer has failed to pay advance tax or paid less than 90% of the assessed.